Read time – 5 minutes

Now is the time to reassess your segmentation and targeting methods.

Dan Nelson, Jr., President & CEO, Nelson Schmidt, Inc.

Back in 2015, we embarked on pioneering a better way for marketers to understand and influence customers’ buying behavior.

Our methodology of Considered Purchase Marketing involves a more intimate understanding of the customer mindset throughout their purchase decision-making process.

THE OPPOSITE OF AN IMPULSE BUY, A CONSIDERED PURCHASE IS A COMPLEX BUYING DECISION WITH A HIGH DEGREE OF FINANCIAL AND/OR EMOTIONAL RISK AND REWARD, REQUIRING MEANINGFUL DELIBERATION PRIOR TO PURCHASE.

By harvesting deeper insights into what motivates customers along their buying journeys, we can create the optimal marketing mix by using data and analytics to intersect and influence the purchase decisions more directly at every stage.

HEIGHTENED EMPHASIS ON CUSTOMER EXPERIENCE

As we continue to apply Considered Purchase Marketing strategies to attract today’s empowered buyers, we see increasing evidence to back up our methodology. We believe that nowhere is our challenge to traditional marketing approaches more relevant than in the financial services industry.

The latest trends indicate a significant convergence towards increased levels of customer-centricity. These shifts are requiring marketers to rethink their ways and therefore, a competitive opportunity exists for those that choose to redefine how to reach and influence the brand choice of their target audiences.

Learn to influence buying decisions at every stage. Contact our CMO, Christopher Vitrano today.

THE BUSINESS CASE FOR IMPROVED UNDERSTANDING OF CUSTOMER BEHAVIOR

Take a look at Deloitte’s “Collection of Financial Services 2020 Outlooks”and you’ll see that customercentric growth drivers are revealed throughout their insight reports. For instance:

What this clearly means to us is that financial services companies of all sizes and across multiple sectors must optimize their marketing investments to meet revenue expectations. That puts CMOs and their teams under more pressure than ever to accelerate business performance. Therefore, marketing organizations must audit their traditional practices and reevaluate what they’re capable of accomplishing and how they go about getting it done.

WHAT MARKETERS NEED TO DO DIFFERENTLY

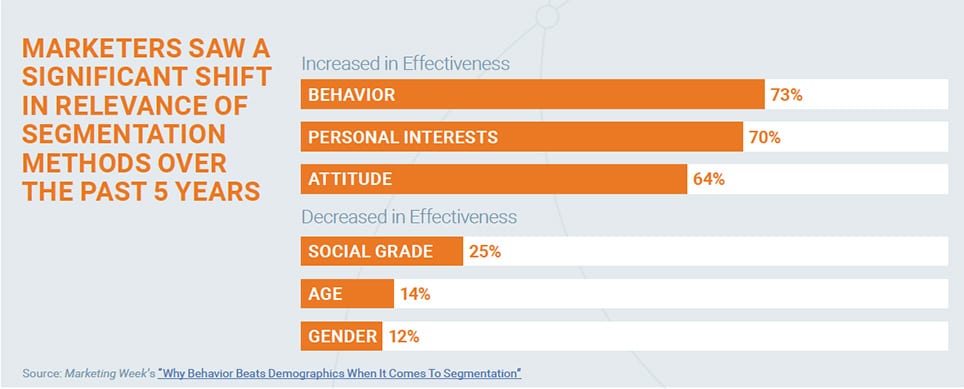

According to Marketing Week’s “Why Behavior Beats Demographics When It Comes To Segmentation,” (behind paywall) their research uncovers that “marketers are shifting away from classic demographics to find more nuanced ways to segment consumers based on their behavior, personal interests and life stage.”

Their findings also show that “classic demographics like age and gender – despite being tried and tested for years – appear to be losing their popularity among marketers as the most common forms of segmentation.”

Frankly, we couldn’t agree more with their discoveries and say throw out your traditional marketing playbooks! Instead, focus on your target customer’s journey and understand where, as marketers, you can directly and indirectly influence their purchase decision through every available channel. Use data to map and measure their journeys and intimately understand the mindset of all your audiences.

TECHNOLOGY ENABLES STRONGER CUSTOMER SEGMENTATION

Technology has now enabled marketers to create a potent starting segmentation based on both traditional demographic considerations blended with prospect and customer behavior and interest metrics.

The true potential of the approach, however, does not stop there but uses technology such as marketing automation to learn more and more about individual prospect and customer interest and behaviors by tracking their digital and real-world footprints and in turn delivering back sharply targeted marketing communications that approach one-to-one messaging. These methods are proven to drive significantly more conversion to desired marketing goals.

BUT IF IT AIN’T BROKE, WHY FIX IT?

It has been our experience that “market leader” and “low-cost provider” brands are often the most resistant to transformation, especially pertaining to marketing innovation. Perpetuating methods of communications that force buyers through the traditional sales funnel may still work for some financial services brands. But we don’t see such thinking lasting within the competitive landscapes where the customer is in control of the information they consume, and therefore create their own journey. In “The Future of Financial Marketing 2020: ‘Show Me The Money,” we like how The Financial Brand describes why some companies choose to maintain status quo:

“WE ARE BEGINNING TO SEE THE TRENDS THAT WILL STAND THE TEST OF TIME IN FINANCIAL MARKETING. NOT ALL WILL BE EMBRACED BY ALL ORGANIZATIONS, EITHER BECAUSE OF BUDGET LIMITATIONS AND/OR LACK OF SKILL SETS OR THE CULTURE REQUIRED TO MOVE FORWARD.”

-The Financial Brand

TAKE A QUICK SELF-ASSESSMENT OF YOUR READINESS TO EVOLVE YOUR CUSTOMER INSIGHT CAPABILITIES

How well do your current marketing efforts align to your customers’ mindsets along the entire purchase journey? Are you implementing new tools, technologies and techniques to the planning and execution of your marketing strategy?

Staying on top of the ever-shifting options is becoming harder and harder. But it doesn’t need to be if you understand how your current approaches rate.

That’s why we built an interactive self-assessment tool that can help you bring an informed point of view to making the right choices for marketing transformation in your organization.

Try it to see where you’re at and see what you can do about it!

Speak CMO to CMO

Learn to influence buying decisions at every stage. Contact our CMO, Christopher Vitrano today.

ABOUT THE AUTHOR: Dan Nelson, Jr. is President & CEO of Nelson Schmidt Inc., an independent full-service marketing agency with offices in downtown Milwaukee and Madison, Wisconsin. NS focuses on Considered Purchase Marketing for U.S. and international clients within select industries. We are members of MAGNET, the Marketing & Advertising Global Network, and the Association of National Advertisers (ANA).